DAFs 101: Introduction and how-to guide for nonprofits

Donor-advised funds (DAFs) have quickly become one of the most active charitable giving vehicles in philanthropy.

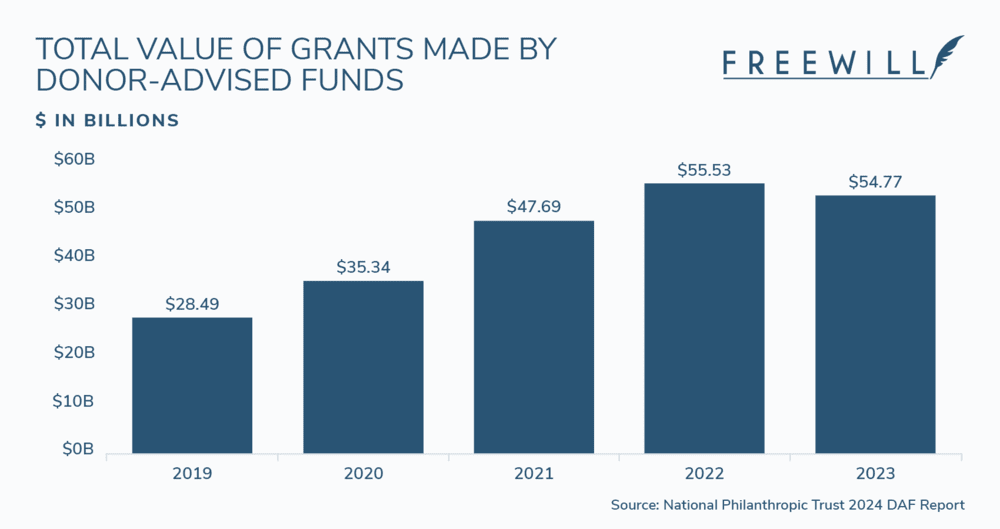

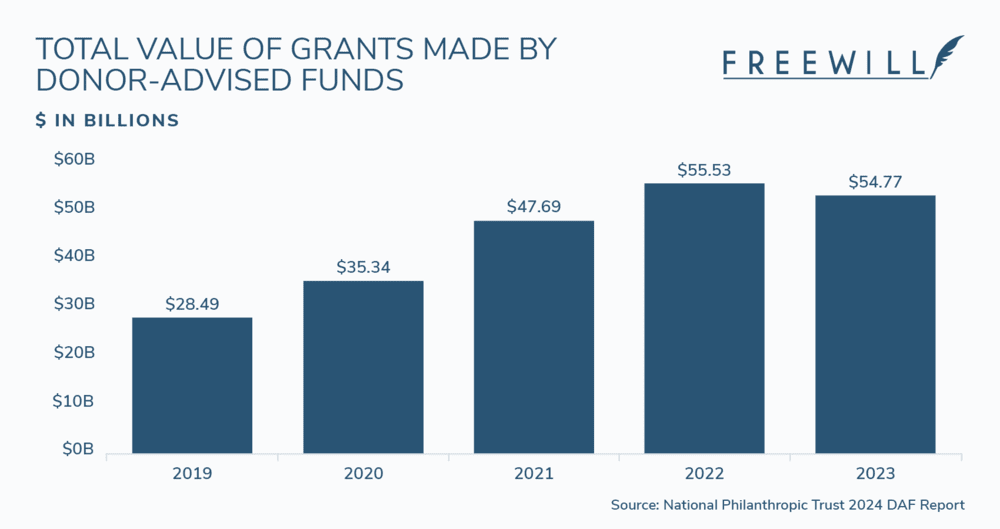

They’ve grown significantly in recent years, consistently hitting record highs across all metrics. Currently, DAF donors are mirroring general giving trends across the entire philanthropic sector in response to economic forces by making more conservative contributions to their DAF accounts. However, these gifts are still a powerful philanthropic force. In 2023, donor contributions totaled $59.43 billion, and DAF grants made to nonprofits were $54.77 billion (Nonprofit Philanthropic Trust’s 2024 DAF Report).

To put this explosive growth into context, grants from DAFs in 2012 totaled $8.52 billion, meaning payouts to nonprofits have more than sextupled in a decade. And for the most part, nonprofits are keeping up. 80% of nonprofits report that DAFs will be more important to their organizations in the coming year, and 51% of organizations are considering actively shifting their 2025 strategy toward encouraging these gifts (The 2025 FreeWill DAF Report).

New forms of giving are on the rise, and donor-advised funds must be a key part of your nonprofit’s strategic plan.

If you can get smart on DAFs now, you’ll secure the future of your organization for years to come. This crash course will equip you with the knowledge you need to get started. We’ll review key trends and terms to understand, how to identify DAF donors, how to develop your DAF strategy, and more.

Understanding donor-advised funds: The basics

What is a donor-advised fund (DAF)?

A donor-advised fund (DAF) is a philanthropic financial vehicle in which donors contribute money to an investment fund managed by a sponsoring organization. Donors can contribute cash and a wide range of non-cash assets, including stocks, shares of mutual funds, publicly traded securities, private assets, and crypto.

After the sponsoring organization invests the funds to grow them, donors can recommend grants be made to charities of their choice using money from the fund. Although “recommend” is the industry term for this process, it’s helpful to note that sponsoring organizations rarely decline a donor’s grant wishes.

How do donor-advised funds work?

Here's how the process works:

- A donor opens a donor-advised fund account. They typically have to contribute between $5,000 and $25,000, meaning they’re used most often by wealthy donors.

- The DAF’s sponsoring organization actively manages and invests the funds. This provides tax-free growth.

- The donor also receives an immediate tax deduction. This occurs when they contribute to the fund.

- The donor recommends the funds be donated. When the donor decides to donate using the fund, they’ll recommend a charity to the sponsoring organization, which will then disburse the gift as a grant.

There are no limits to the contributions and grants that donors can make, and they can even set up recurring grants to their favorite nonprofits—Fidelity Charitable's 2025 Giving Report found that nearly 80% of DAF grants are not a donor’s first gift to a nonprofit.

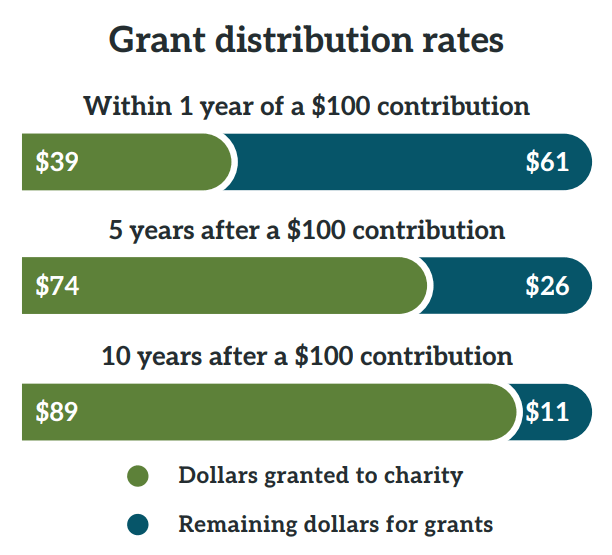

There is some worry that DAF account holders won’t make grants for a long time after contributing funds. While this can happen, we’ve seen that most DAF dollars get to nonprofits relatively quickly in a steady flow.

The same Fidelity Charitable report cited above also found that out of a hypothetical $100 contribution, $39 is granted to nonprofits within 1 year, $74 within 5 years, and $89 within 10 years. DAFs consistently grant funds at much higher rates (above 20% on average) than the 5% annual minimum payout rate for foundations.

What are the types of DAF sponsoring organizations?

There are three primary types of DAF sponsoring organizations:

- Community foundations — independent charitable foundations created for the benefit of residents of a specific area

- National organizations — charitable arms of financial services providers, like Fidelity or Schwab

- Single-issue organizations — institutions that create DAF programs to support a specific identity, faith, or cause

Community foundations and single-issue organizations have offered and managed DAFs for many years. National DAFs are relative newcomers that have contributed to the explosive rise of this type of giving.

Why do donors use DAFs?

DAFs provide donors with a flexible way to give to causes they care about and a tax-savvy method for setting aside money specifically for that purpose.

Donor-advised funds have significantly increased in popularity with donors in recent years, consistently setting record highs in the total value of contributions, the value of grants made, and the number of individual DAF accounts. More donors are turning to DAFs each year as a smart way to manage their giving habits.

What’s driving this growth? The 2017 Tax Cuts and Jobs Act spurred an increased interest in DAF giving by encouraging wealthy donors to give larger gifts in less frequent intervals in order to maximize their tax benefits. Even amid a turbulent economy, DAFs have remained a popular, highly flexible way for wealthy donors to secure tax savings.

This growth has been sustained thanks in part to the increased accessibility offered by national DAFs, which often have $0 minimum contributions to start a fund. These sponsoring organizations have quickly dominated the space, with their total assets reaching over $170 billion in 2023. That year, they disbursed over $35 billion in grants, representing 64.1% of all DAF dollars granted to nonprofits.

How can nonprofits secure DAF grants?

So how can nonprofit organizations begin tapping into the incredible opportunities of donor-advised fund grants? By connecting with and growing their relationships with philanthropic individuals who own DAFs.

We’ll explore tips for reaching and stewarding these donors below. First, let’s take a closer look at the reasons why DAF fundraising is such a valuable investment for organizations (of all sizes and sophistication levels).

Key DAF trends to understand

Understanding the field of DAFs will help you build a better strategy for securing these gifts. Let’s review a few key trends, including many from the most recent FreeWill DAF Report.

First, take a look at the big picture of DAF growth in recent years:

We've seen a clear trend of explosive growth in DAF grant payouts to nonprofits since 2018. Even amid stock market declines and inflation, DAF grants have still grown as donors continue supporting their favorite causes with funds already allocated for that purpose.

- DAFs hold a lot of wealth, totaling over $251.52 billion in 2023.

- Payout rates have held relatively steady despite economic disruptions, sitting at around 24%, but the total value of those payouts has increased to a record high at $54.77 billion.

- DAF donors are loyal to their favorite organizations. Fidelity Charitable found that nearly 80% of grants they facilitated in 2024 went to a nonprofit that the donor had supported in the past, and 31% of those were pre-scheduled or recurring donations.

- DAF donors are increasingly generationally diverse. One study found that Millennials, Gen X, and Baby Boomer donors are now almost equally represented among DAF funders. Millennials are expected to play an even larger role in the DAF landscape amid the ‘Great Wealth Transfer’ that’s changing the world of planned giving.

How are nonprofits currently approaching DAFs? We surveyed nearly 500 nonprofits across the size and mission spectrum to learn more:

- 83% report that DAFs will be more important to their nonprofits this year than in previous years.

- 71% of respondents think that DAFs make it easier for donors to give complex gifts. They also rank DAFs as the most common type of non-cash gift they receive, surpassing stocks and QCDs.

- 57% of organizations view DAFs as a more reliable source of funding during economic downturns. 22% view DAF gifts as just as reliable, while 17% are unsure. Only 3% view it as less reliable.

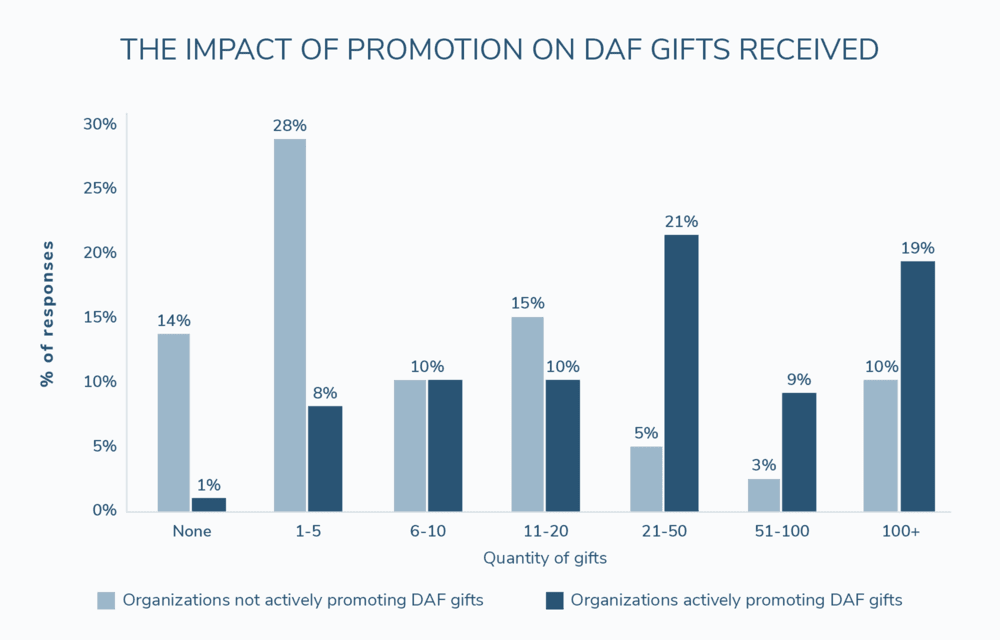

- 64% of respondents are currently actively soliciting or promoting DAFs, up from 58% in 2023. Of the organizations that do pursue DAFs, 99% reported receiving at least one DAF gift in 2024.

This last point is particularly important—if your nonprofit wants to receive DAF gifts, you must actively seek them out. Take a look at this graph:

The dark blue bars show the number of DAF gifts received by organizations that raise more than $10 million in individual contributions annually and actively asked for DAFs last year. Only 1% received none, 19% received 100+, and the rest received 1-100. These organizations most commonly received 21-50 DAF gifts in 2024. The light blue bars show organizations that receive between $1 and $10 million and did not actively promote DAF giving. 42% of those respondents reported receiving 5 or fewer gifts.

The takeaway: Making DAFs an active fundraising priority (not just a passive form of funding that you wait to receive) will drastically increase your chances of success.

However, the unique challenges of these gifts are what keep many nonprofits from investing in them. 60% of nonprofits report DAF donor identification as their biggest hurdle—after all, DAF ownership isn’t publicly available information. Meanwhile, 30% of respondents also indicated that too many anonymous donations pose challenges. We’ll show you how to navigate this and other challenges below.

Summing up: Why DAFs matter for nonprofits

Here are the three biggest reasons why DAFs warrant investment from nonprofits:

- They hold a lot of wealth that’s already been set aside for philanthropic purposes.

- DAF donors tend to be quite loyal, often giving repeat (and even pre-scheduled) gifts to their favorite organizations.

They drastically simplify the process of non-cash giving for both you and your donors. It’s been shown that non-cash fundraising fuels nonprofit growth. Assets contributed to DAFs are immediately liquidated, meaning there’s no need for coordination with brokerages. That means less administrative complexity for you, and easier experiences for donors—a win-win.

How to receive DAF gifts

So how do you get started soliciting and securing DAF gifts?

Let’s review how to receive DAFs, tips for starting your program, and best practices for stewarding your relationships with high-impact DAF donors. To start, know that DAF fundraising tools like DAFpay will be instrumental in securing these donations. They make it easy for donors to make DAF grants while providing your team full visibility into donor gifts and details.

Broken into basic steps, the DAF fundraising process works like this:

- You identify potential DAF donors and sponsoring organizations like local community foundations.

- Your nonprofit works to build connections with the DAF prospects and engage them with its events, campaigns, and programs.

- You develop a DAF fundraising process and/or use a tool like DAFpay to facilitate the giving process and ensure data collection—more on this below.

- Your team maintains communication with prospects over time and highlights DAF giving as a donation option, either through general promotions or direct outreach.

- You solicit a DAF gift and direct prospects to your DAF giving process

- A donor officially recommends to their sponsoring organization that your nonprofit receive a DAF grant. They provide some basic information and fill out your quick form to notify you of the gift.

- The sponsoring organization sends your nonprofit the donation electronically or by check.

- You then kick off the recognition and stewardship process to continue growing your relationship with the donors.

Note that since donors are only eligible to claim a tax deduction when they contribute to their DAF account (not when they grant money to a nonprofit), you may consider restating that the donation is not tax-deductible in your acknowledgment letter. We’ve included a free DAF donation acknowledgment template in a section below.

How to identify DAF donors for your nonprofit

Finding DAF donors is consistently reported as the biggest challenge with this form of fundraising (60% of nonprofits ranked it as the top challenge in 2024).

By mastering a few best practices, you can conquer this first major hurdle and make the rest of your DAF fundraising a breeze. Here are our recommendations:

1. Actively promote donor-advised funds on your donation page.

Your nonprofit's marketing is a big part of identifying DAF giving opportunities. Include a link that says “Give from my Donor-Advised Fund” on your primary donation page.

By putting this link on a page where donors are already preparing to give, you can encourage larger gifts from those looking to make a donation and who have a DAF or are interested in setting one up. This link should then take them to a separate page that guides them through the DAF grant process. You should also include your contact information for donors who would like to learn more about giving this way.

The American Red Cross has a great example of a helpful DAF giving page. It includes more information about what donor-advised funds are and how to give DAF gifts by mail or online.

2. Ask major donors and prospects if they have DAFs.

Remember that DAFs have exploded in popularity in recent years. Many of your major giving prospects might already have donor-advised funds, so bring up these gifts in any one-on-one conversations you have with them about giving.

To be effective, use social proof, which is the idea that people want to act in ways similar to their peers. For example, you can say: “Many of our supporters give out of a donor-advised fund. Would you like information on how other donors are using their DAFs to make a big impact?"

Keep in mind that donors with donor-advised funds may also have the option to name your nonprofit as a beneficiary to receive a dollar amount or percentage of remaining funds upon their passing. Integrate mentions of DAFs into your planned giving stewardship strategies, and record your findings as you learn more about the donors who fit into both your planned giving prospect and DAF giving prospect segments.

3. Make sure your Guidestar profile is up-to-date.

National DAF sponsoring organizations (like Fidelity and Schwab) that now manage the majority of active DAFs typically do not play active roles in recommending charities to receive grants. Trying to build direct relationships with these organizations will likely be a waste of time.

Instead, make sure your Guidestar profile is up-to-date. Most national DAFs use this as a resource to ensure money is being routed correctly and to double-check that nonprofits are in good standing.

4. Get to know the leaders of your local community foundations.

Among sponsoring organizations, community foundations more actively recommend nonprofits to DAF account holders, and they’re still significant players in the space. Grants from community foundations made up 22.7% of total grant dollars in 2023, and the average account size at these organizations was $528,209, more than four times greater than that of national sponsoring organizations (Nonprofit Philanthropic Trust’s 2024 DAF Report).

Community foundations are still a legacy choice for many wealthier DAF donors, and you can more easily build relationships with them the way you would with other foundations when seeking grants.

Set up meetings with their giving teams to learn what community foundations are looking to fund or their key areas of focus. Invite them to events and tours, and keep them updated on your organization’s exciting developments. You can approach them when you have a program or initiative that seems to be a good match for their donors.

Donor-advised fund stewardship essentials

Having a stewardship plan in place to actively foster and grow your relationships with DAF donors will be key to long-term success. Remember that the majority of DAF grants are given to nonprofits that the donor has previously supported, meaning if you can build a lasting relationship with these donors, you’ll likely see more and larger gifts.

Consider these best practices:

- Have a system in place for tracking DAF gifts over time. This could be as simple as creating a special tag in your database that makes it easy to segment by DAF donors. To go the extra mile and provide a stellar giving experience, use software like DAFpay, provided by FreeWill, to simplify the DAF donation process and automatically report new insights for future reference or to integrate with your other data tools.

- Create an organized outreach cadence. Actively stay in touch with your DAF donors. A member of your development team should own the relationship, following and adapting a standard outreach calendar to check in with the donor, provide updates, and extend invitations.

- Invite them to get involved. Drive long-term engagement beyond just staying in touch by inviting your DAF donors to public events and private gratitude gatherings, telling them about interesting volunteer opportunities, and more. For your most impactful donors, help them feel involved and invested by seeking their input when appropriate, like during a campaign feasibility study.

- Anchor your messaging with gratitude and impact. Continually strive to show your donors the positive, specific impact that their support has had so far. Back it up with a mix of compelling stories and hard data when possible.

- Learn more about your donors. Record new insights on your donors as you stay in touch over time—their jobs, families, interests, life developments, and more. This information, along with regular wealth screening and prospect qualification, makes it easy to tailor your outreach in ways that will best resonate with your donors as individuals. Use what you know to invite them to an event you know they’ll love, or ask them about their estate plans if they fit your planned donor persona.

Bonus: DAF donor acknowledgment letter template

As you build your DAF stewardship process, don’t forget that the very first post-gift touchpoints are among the most important! You need to quickly acknowledge and thank donors no matter how they give.

Acknowledge DAF gifts with timely, clearly-worded messages using our free template:

Remember, donors receive a tax deduction when they contribute to their DAF, not when they give to a nonprofit. We recommend including a reminder that the gift is not tax-deductible in your acknowledgment message.

Getting started and learning more about DAFs

To start pursuing gifts from donor-advised funds, begin by ensuring you have the right tools and resources for the job. You’ll need:

- A dedicated giving page about DAFs (potentially on your planned giving microsite) or a dedicated section about DAFs on your primary giving page

- A DAF giving tool, like DAFpay by Chariot, that simplifies the grant recommendation process and captures the donation data you need

- Printed and digital collateral about DAF giving, how it works, its benefits for donors, and why it’s so helpful for your organization

- A defined process for tracking DAF gifts and donors over time for follow-up and stewardship purposes

With these essentials in place, you’ll be in a great position to start consistently securing DAF gifts. Bring them up in conversations with your top donors and prospects. Send a segmented email explaining that you now accept gifts from donor-advised funds and would be happy to answer any questions. Highlight DAFs on your nonprofit’s blog. Reach out to local community foundations or single-issue organizations to learn more about their DAF programs.

The keys to success are to be prepared, active, and knowledgeable. Learn more about donor-advised with our most recent Donor-Advised Fund Report, our past webinars, or keep exploring with these resources:

- The easiest way to make an impact through donor-advised funds

- How to accept stock donations: What nonprofits need to know

- 10 types of planned gifts your nonprofit should know

Ready to kick start your DAF fundraising efforts? FreeWill can help. Let’s discuss your nonprofit’s DAF fundraising goals.

FreeWill simplifies every part of launching and running your nonprofit's DAF program.

FreeWill simplifies every part of launching and running your nonprofit's DAF program.